Feie Calculator Things To Know Before You Buy

Table of ContentsNot known Facts About Feie CalculatorThe Only Guide to Feie CalculatorFeie Calculator Can Be Fun For AnyoneSome Known Details About Feie Calculator Feie Calculator Things To Know Before You BuyThe Main Principles Of Feie Calculator Feie Calculator for Beginners

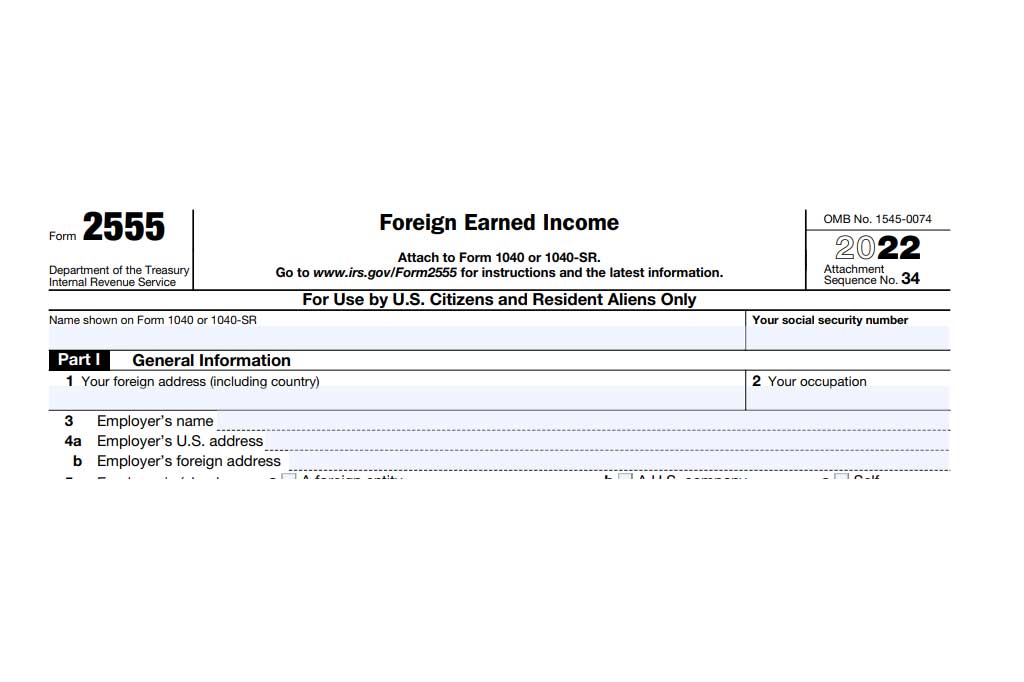

If he 'd regularly taken a trip, he would certainly rather complete Part III, listing the 12-month period he satisfied the Physical Presence Test and his traveling history. Step 3: Reporting Foreign Revenue (Part IV): Mark made 4,500 per month (54,000 every year).Mark determines the exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his income (54,000 1.10 = $59,400). Considering that he lived in Germany all year, the portion of time he resided abroad during the tax is 100% and he gets in $59,400 as his FEIE. Mark reports complete salaries on his Kind 1040 and gets in the FEIE as an adverse amount on Schedule 1, Line 8d, minimizing his taxable revenue.

Picking the FEIE when it's not the very best alternative: The FEIE might not be ideal if you have a high unearned income, earn greater than the exemption limit, or stay in a high-tax country where the Foreign Tax Obligation Credit Report (FTC) might be a lot more valuable. The Foreign Tax Obligation Credit Report (FTC) is a tax decrease strategy commonly made use of together with the FEIE.

Things about Feie Calculator

expats to offset their united state tax obligation financial obligation with international revenue taxes paid on a dollar-for-dollar decrease basis. This indicates that in high-tax countries, the FTC can typically eliminate united state tax debt completely. However, the FTC has constraints on eligible tax obligations and the maximum case amount: Qualified taxes: Only earnings taxes (or tax obligations instead of revenue taxes) paid to foreign governments are eligible.

tax responsibility on your international income. If the foreign taxes you paid exceed this limitation, the excess foreign tax obligation can generally be continued for approximately 10 years or carried back one year (through a modified return). Preserving exact documents of foreign revenue and taxes paid is as a result essential to computing the right FTC and keeping tax obligation conformity.

expatriates to lower their tax liabilities. If a United state taxpayer has $250,000 in foreign-earned income, they can exclude up to $130,000 using the FEIE (2025 ). The staying $120,000 may then go through taxes, but the united state taxpayer can possibly use the Foreign Tax Credit score to counter the taxes paid to the foreign nation.

Feie Calculator Fundamentals Explained

He sold his U.S. home to develop his intent to live abroad completely and used for a Mexican residency visa with his wife to aid accomplish the Bona Fide Residency Examination. Additionally, Neil safeguarded a long-term property lease in Mexico, with plans to at some point acquire a residential property. "I presently have a six-month lease on a home in Mexico that I can expand one more 6 months, with the purpose to acquire a home down there." Neil directs out that buying residential or commercial property abroad can be challenging without first experiencing the area.

"We'll absolutely be beyond that. Even if we come back to the United States for doctor's visits or organization calls, I doubt we'll spend more than thirty days in the United States in any type of offered 12-month period." Neil stresses the significance of rigorous monitoring of united state sees. "It's something that people need to be actually diligent concerning," he states, and encourages expats to be careful of common errors, such as overstaying in the U.S.

Neil is careful to anxiety to U.S. tax obligation authorities that "I'm not performing navigate to this website any kind of service in Illinois. It's just a mailing address." Lewis Chessis is a tax consultant on the Harness system with substantial experience helping U.S. people navigate the often-confusing world of global tax conformity. Among the most usual false impressions among U.S.

An Unbiased View of Feie Calculator

income tax return. "The Foreign Tax obligation Credit scores enables individuals functioning in high-tax nations like the UK to offset their united state tax obligation by the amount they have actually currently paid in tax obligations abroad," claims Lewis. This makes certain that expats are not exhausted two times on the exact same revenue. Nevertheless, those in reduced- or no-tax nations, such as the UAE or Singapore, face extra obstacles.

The possibility of reduced living costs can be alluring, but it usually includes trade-offs that aren't right away obvious - https://anyflip.com/homepage/taqqj#About. Housing, for example, can be more budget-friendly in some nations, yet this can imply endangering on infrastructure, safety, or accessibility to trustworthy utilities and services. Economical residential or commercial properties may be found in locations with irregular internet, minimal mass transit, or unstable medical care facilitiesfactors that can significantly influence your everyday life

Below are several of one of the most regularly asked questions regarding the FEIE and other exemptions The Foreign Earned Income Exemption (FEIE) enables U.S. taxpayers to leave out as much as $130,000 of foreign-earned revenue from federal revenue tax, reducing their united state tax obligation. To receive FEIE, you have to satisfy either the Physical Existence Examination (330 days abroad) or the Authentic House Examination (confirm your primary home in an international nation for a whole tax year).

The Physical Visibility Test requires you to be outside the U.S. for 330 days within a 12-month period. The Physical Visibility Test additionally needs U.S. taxpayers to have both a foreign earnings and an international tax home. A tax obligation home is specified as your prime area for service or work, despite your family's home. https://trello.com/w/feiecalcu.

Unknown Facts About Feie Calculator

An earnings tax obligation treaty in between the united state and one more nation can aid avoid dual taxation. While the Foreign Earned Earnings Exemption decreases taxable earnings, a treaty may give fringe benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a called for declaring for U.S. citizens with over $10,000 in foreign monetary accounts.

Neil Johnson, CPA, is a tax obligation consultant on the Harness system and the creator of The Tax Guy. He has over thirty years of experience and now concentrates on CFO solutions, equity compensation, copyright taxation, cannabis taxation and separation relevant tax/financial planning issues. He is a deportee based in Mexico.

The international gained revenue exclusions, occasionally described as the Sec. 911 exemptions, omit tax obligation on incomes gained from working abroad. The exemptions comprise 2 components - an income exemption and a housing exemption. The adhering to Frequently asked questions go over the benefit of the exclusions consisting of when both spouses are deportees in a general fashion.

Some Ideas on Feie Calculator You Need To Know

The revenue exemption is currently indexed for inflation. The maximum yearly income exclusion is $130,000 for 2025. The tax obligation advantage omits the revenue from tax obligation at lower tax rates. Previously, the exemptions "came off the top" minimizing income based on tax at the leading tax rates. The exclusions might or might not minimize revenue used for various other purposes, such as IRA limits, kid credit reports, individual exceptions, and so on.

These exclusions do not excuse the wages from US taxation but simply give a tax obligation reduction. Keep in mind that a bachelor working abroad for all of 2025 who made regarding $145,000 without any other revenue will certainly have gross income minimized to absolutely no - efficiently the same answer as being "tax obligation totally free." The exemptions are computed each day.

If you participated in service meetings or workshops in the United States while living abroad, earnings for those days can not be excluded. Your salaries can be paid in the US or abroad. Your company's area or the location where wages are paid are not consider getting the exclusions. Physical Presence Test for FEIE. No. For United States tax obligation it does not matter where you keep your funds - you are taxed on your around the world income as an US individual.